The Budget Summary for March 2024 stands as a pivotal moment, revealing the latest measures and initiatives set forth by policymakers to navigate the challenges and opportunities ahead. From taxation adjustments to investment strategies, this summary encapsulates the government's vision for economic resilience and growth.

From key announcements to their potential impact on businesses and individuals alike, this comprehensive overview aims to shed light on the policies shaping our financial future. Let's unpack the implications and explore the pathways charted in this latest fiscal roadmap.

Significant points announced by the chancellor on 06/03/2024:

Personal tax rates and allowances on income continue to be frozen at current levels

Further cuts to National Insurance Contributions in addition to those announced in the Autumn Statement, to take effect in April 2024

Increase in threshold for High Income Child Benefit Charge from £50,000 to £60,000 for 2024/25

Maximum rate of CGT on residential property cut from 28% to 24% from 6 April 2024

Advantageous tax treatment of furnished holiday lets abolished from 6 April 2025

Advantageous tax treatment of ‘non-doms’ abolished from April 2025 and replaced with a ‘residence-based’ system

Increase in turnover threshold for VAT registration to £90,000 from 1 April 2024

Personal Income Tax

Tax rates and allowances – 2024/25 (Table A)

The main personal allowance and the 40% threshold will remain at their 2022/23 levels until the end of 2027/28.

The income level above which the personal allowance is tapered away remains £100,000; it will be reduced to zero when income is £125,140, which is also the threshold for paying 45% tax.

High Income Child Benefit Charge (HICBC)

For 2024/25 the threshold has been raised from £50,000 to £60,000 so that the whole benefit is lost when income reaches £80,000 (£60,000 in 2023/24). The HICBC is one reason that an individual might have to register for self-assessment and file a tax return.

The Chancellor announced plans to reform the HICBC from April 2026 to take into account the combined income of the household, rather than just the higher earner.

Dividend income

The dividend allowance exempts some dividend income from tax, although that income still counts towards the higher rate thresholds. For 2024/25, the allowance is reduced from £1,000 to £500 (it was £2,000 up to 2022/23).

The tax rates on dividend income over £500 remain unchanged from the tax year 2022/23. The ordinary rate, paid by basic rate taxpayers, is 8.75%, the upper rate is 33.75%, and the additional rate is 39.35%. These rates apply across the UK.

Interest rate on overdrawn Director Loan Accounts

The 33.75% rate also applies to tax payable by close companies (broadly, those under the control of five or fewer shareholders) on ‘loans to participators’ that are not repaid to the company within 9 months of the end of the accounting period.

ISA or VCT

The reduction in the dividend allowance and the increase in the tax rates increases the relative attractiveness of holding shares in a tax-free ISA or in a Venture Capital Trust. Dividends arising in an ISA or a qualifying VCT are not taxed and do not count towards the allowance.

Savings income

The savings allowance remains £1,000 for basic rate taxpayers, £500 for 40% taxpayers and nil for 45% taxpayers.

Foreign domiciled individuals

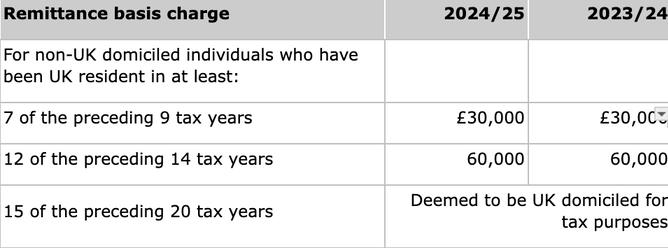

Individuals who are classed as ‘not UK domiciled’ (often referred to as ‘non-doms’) enjoy a number of tax advantages in relation to foreign income and gains, which will only be taxed if the money is brought to the UK (if the individual claims the ‘remittance basis of taxation’). Some of these advantages have been restricted in recent years, but the Chancellor has now announced that the system will be reformed and replaced with effect from 6 April 2025.

Employees

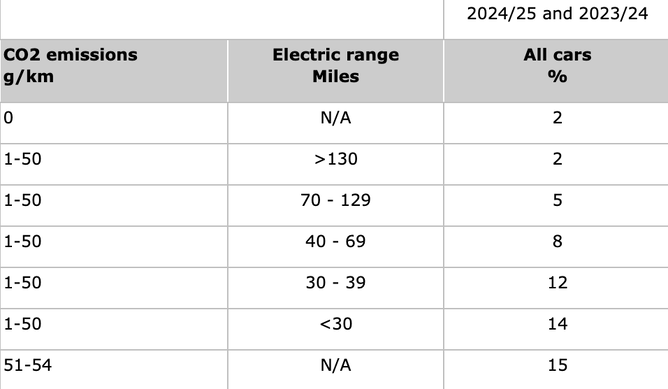

Company cars and fuel (Table C)

The basis for taxing company cars and fuel provided for private use is set out in Table C. Annual increases in the rates for use of the car have been announced up to 2027/28, but the figure used to calculate the benefit of free use of business fuel for private journeys remains fixed for the moment at £27,800. The rates continue to incentivise the take-up of electric cars, even though they can no longer be provided completely tax-free.

The taxable amounts for the availability of a van for more than incidental private use, and for an employee’s private use of fuel in a company van, normally increase in line with inflation. However, the 2023/24 flat rate figures of £3,960 and £757 for these benefits remain the same for 2024/25. Electric vans remain a tax-free benefit.

National Insurance Contributions (NIC)

Thresholds and rates (Table D)

In his 2022 Autumn Statement, the Chancellor announced that the thresholds for NIC would remain fixed until 2027/28. In the 2023 Autumn Statement he announced a reduction in the main rate of Employees’ Class 1 NIC from 12% to 10% to take effect from 6 January 2024; in the Spring Budget he has cut the rate further to 8% with effect from 6 April 2024.

In the Autumn Statement the Chancellor announced an intention to cut Class 4 NIC for the self-employed from 9% to 8% from 6 April 2024, but he has now taken this further and reduced the main rate to 6%.

Class 2 NIC

Self-employed people have for many years had to pay flat rate Class 2 NIC, which have conferred entitlement to State pension, as well as profit-related Class 4 NIC. As announced in the Autumn Statement, from 6 April 2024, Class 2 NIC will not be required to secure benefits for anyone earning above £6,725, saving £179.40 a year for those earning over £12,570. Anyone earning less than that can still pay Class 2 voluntarily in order to maintain a full contribution record; the Spring Budget included an announcement that the Government will consult later this year on how to achieve abolition of Class 2 for those people as well.

Savings and Pensions

Individual Savings Accounts (ISA)

The investment limits for 2024/25 remain £20,000 for a standard adult ISA (within which £4,000 may be in a Lifetime ISA – unchanged since 2017/18), and £9,000 for a Junior ISA or Child Trust Fund.

The Chancellor announced a consultation on a new ‘British ISA’, which would give an additional annual allowance of £5,000 to be invested in British companies. No date has been set for the introduction of this product.

Pension contributions (Table B)

In last year’s Budget the Annual Allowance was increased to £60,000, and the Lifetime Allowance (LTA) Charge was abolished. No further changes were announced in the Spring Budget.

Although the LTA itself has now been formally abolished, the maximum amount that can be withdrawn as a tax-free lump sum remains 25% of the previous LTA (25% x £1,073,100 = £268,275) unless the person is entitled to ‘protection’ in relation to the original introduction of the LTA or any of the subsequent reductions of the limit.

Capital Gains Tax

As announced in the 2022 Autumn Statement, the CGT annual exempt amount will be cut from £6,000 in 2023/24 to £3,000 for 2024/25. The rates of CGT are unchanged at 10% for basic rate taxpayers and 20% for higher rate taxpayers on general assets.

The rate of CGT on disposals of chargeable residential property (such as second homes and rental properties) has been 18% for gains falling within a taxpayer’s basic rate band and 28% for higher rate taxpayers. The 28% rate is reduced to 24% for disposals on or after 6 April 2024.

The substantial reduction in the exempt amount (from £12,300 in 2022/23) will increase the tax payable, and it is also likely to require more people to complete self assessment returns in order to report chargeable gains.

Changes of basis

Although there were no new announcements in this Budget, two important changes are coming in on 6 April 2024. After a transitional year in 2023/24, self-employed trading profits will be assessed on a fiscal year basis in 2024/25, regardless of the accounting date chosen by the business. Anyone who has an accounting date other than 31 March or 5 April should have been preparing for this change.

Secondly, the cash basis of accounting becomes the default for calculating trading profits for unincorporated businesses of any size for 2024/25. It will still be possible to choose to calculate profits using accruals accounting. All self-employed traders should consider the impact of the change and decide what is best for them.

Corporation Tax

Rate of tax

The Corporation Tax rate is unchanged at 25% for companies with profits over £250,000. The ‘small profits rate’ remains 19% for companies with profits of up to £50,000. Between £50,000 and £250,000 there is a tapering calculation that produces an effective marginal rate of 26.5% on profits between these limits, but an average rate on all profits of between 19% and 25%. The limits are divided between companies that have been under common control at any time in the previous 12 months, whether UK resident or not.

Capital allowances for plant and machinery

In 2023, ‘full expensing’ (100% relief for the cost in the year of purchase) was introduced for most plant and machinery. It is not currently available to companies that buy plant to lease out to other businesses. The Chancellor announced that ‘the Government will seek to extend full expensing to leased assets ‘when fiscal conditions allow’ and will publish draft legislation shortly.

Value Added Tax

Registration threshold

The VAT registration and deregistration thresholds were previously intended to remain frozen at their present levels of £85,000 and £83,000 until 31 March 2026. In the first increase in the thresholds since April 2017, the thresholds have been increased to £90,000 and £88,000 with effect from 1 April 2024. The Budget announcement says that they will be again frozen at these new levels, but it does not say for how long.

National Living Wage (NLW)

From 1 April 2024, the NLW will apply to those aged 21 or over (currently 23), and will rise from £10.42 per hour to £11.44, with comparable increases to the other rates that apply to younger workers and apprentices.

Income Tax Rates and Allowances

Income Tax Rates and Allowances (Table A)

Main allowances | 2024/25 | 2023/24 |

|---|---|---|

Personal Allowance (PA)*† | £12,570 | £12,570 |

Blind Person's Allowance | 3,070 | 2,870 |

Rent a room relief § | 7,500 | 7,500 |

Trading income § | 1,000 | 1,000 |

Property income § | 1,000 | 1,000 |

*PA will be withdrawn at £1 for every £2 by which ‘adjusted income’ exceeds £100,000. There will therefore be no allowance given if adjusted income is £125,140 or more.

†£1,260 of the PA can be transferred to a spouse or civil partner who is no more than a basic rate taxpayer, where both spouses were born after 5 April 1935.

§ If gross income exceeds this, the limit may be deducted instead of actual expenses.

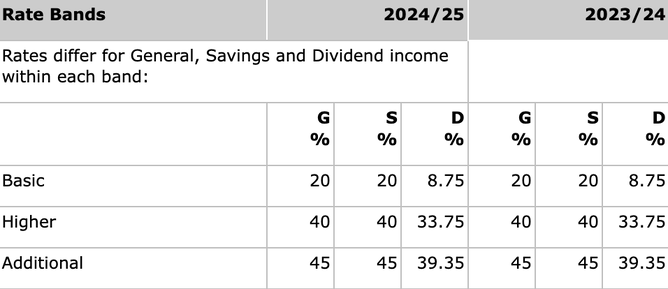

Rate Bands | 2024/25 | 2023/24 |

|---|---|---|

Basic Rate Band (BRB) | £37,700 | £37,700 |

Higher Rate Band (HRB) | 37,701-125,140 | 37,701-125,140 |

Additional Rate (AR) | over 125,140 | over 125,140 |

Personal Savings Allowance (PSA) | ||

– Basic rate taxpayer | 1,000 | 1,000 |

– Higher rate taxpayer | 500 | 500 |

Dividend Allowance (DA) | 500 | 1000 |

BRB and AR threshold are increased by allowable personal pension contributions and Gift Aid donations.

General income (salary, pensions, business profits, rent) usually uses personal allowance, basic rate and higher rate bands before savings income (mainly interest). To the extent that savings income falls in the first £5,000 of the basic rate band, it is taxed at nil rather than 20%.

The PSA will tax interest at nil, where it would otherwise be taxable at 20% or 40%.

Dividends are normally taxed as the ‘top slice’ of income. The DA taxes the first £500 (2023/24 £1,000) of dividend income at nil, rather than the rate that would otherwise apply.

High Income Child Benefit Charge (HICBC)

1% of child benefit for each £200 (2023/24: £100) of adjusted net income between £60,000 and £80,000 (2023/24: £50,000 and £60,000).

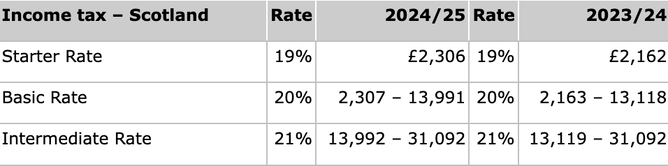

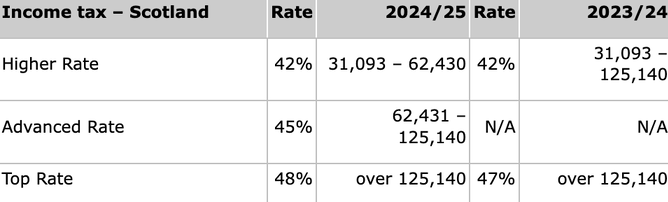

Scottish rates and bands do not apply for savings and dividend income, which are taxed at normal UK rates.

Registered Pensions (Table B)

2024/25 | 2023/24 | |

|---|---|---|

Annual Allowance (AA)* | £60,000 | £60,000 |

Annual relievable pension inputs are the higher of earnings (capped at AA) or £3,600.

The AA is usually reduced by £1 for every £2 by which relevant income exceeds £260,000, down to a minimum AA of £10,000.

The AA can also be reduced to £10,000, where certain pension drawings have been made.

The maximum tax-free pension lump sum is £268,275 (25% of £1,073,100), unless a higher amount is “protected”.

Car and Fuel Benefits (Table C)

Cars

Taxable benefit: List price multiplied by chargeable percentage.

Then a further 1% for each 5g/km CO2 emissions, up to a maximum of 37%.

Diesel cars that are not RDE2 standard suffer a 4% supplement on the above figures but are still capped at 37%.

Car Fuel

Where employer provides fuel for private motoring in an employer-owned car, CO2-based percentage from above table multiplied by £27,800.

National Insurance Contributions

National Insurance Contributions 2023/24 (Table D)

Class 1 (Employees) | Employee | Employer |

|---|---|---|

Main NIC rate | 8% | 13.8% |

No NIC on first | £242pw | £175pw |

Main rate charged up to* | £967pw | No Limit |

2% rate on earnings above | £967pw | N/A |

Employment allowance per qualifying business** | N/A | £5,000 |

*Nil rate of employer NIC on earnings up to £967pw for employees aged under 21, apprentices aged under 25 and ex-armed forces personnel in their first twelve months of civilian employment.

Employer contributions (at 13.8%) are also due on most taxable benefits (Class 1A) and on tax paid on an employee’s behalf under a PAYE settlement agreement (Class 1B).

Class 2 (Self employed)

Flat rate per week if profits below £6,725 (voluntary) | £3.45 |

|---|

Class 3 (Voluntary)

Flat rate per week | £17.45 |

|---|

Class 4 (Self employed)

On profits £12,570 – £50,270 | 6% |

|---|---|

On profits over £50,270 | 2% |

Employees with earnings above £123pw and the self-employed with annual profits over £6,725 (or who pay voluntary Class 2 contributions) can access entitlement to contributory benefits.

Final Words from Accountants in Stafford

The Budget Summary March 2024 paints a picture of ambition and adaptability in the face of economic uncertainties. As we analyse the implications of the announced measures, it becomes evident that informed decision-making will be crucial for businesses and individuals navigating the fiscal landscape ahead.

In this era of change, knowledge is power. Let's embark on this journey together towards a prosperous and resilient future.